Weekly Market Commentary – 12/31/2021

-Darren Leavitt, CFA

Financial market action in the final week of the year was relatively muted. A mild Santa Clause rally did ensue as seasonal factors such as rebalancing and window dressing kicked in. Investors got a full dose of coronavirus news as the Omicron variant continued to spread rapidly. The CDC announced that asymptomatic people could reduce isolation time to 5 days from 10 days and is also expected to include the cohort of 14-15-year-olds for eligibility to receive a booster shot. Still, many flights were canceled due to the virus, and New Year’s festivities were curtailed, giving some pause to the reopening trade.

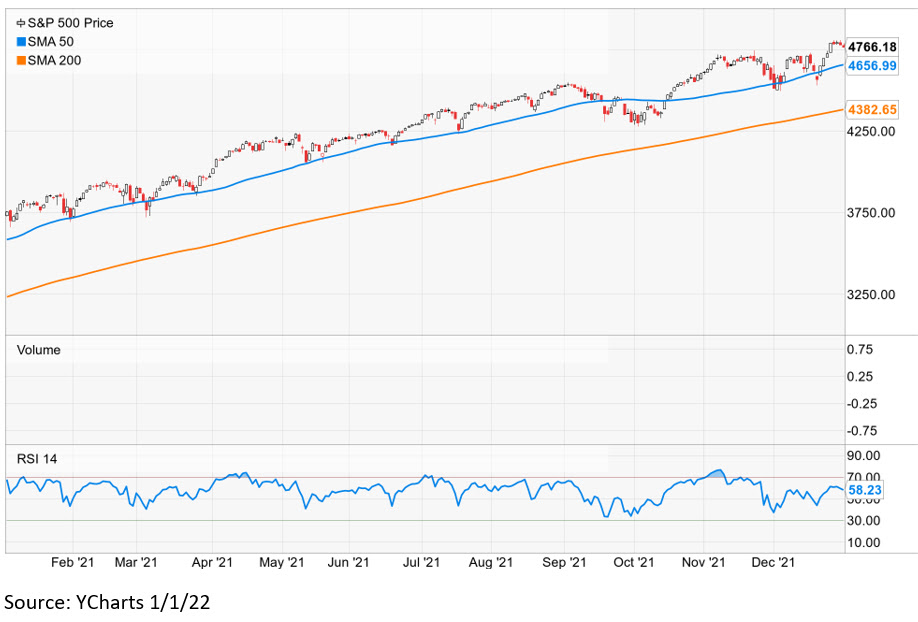

The S&P 500 gained 0.9% for the week and closed the year 26.9% higher. The Dow added 1.1%, the NASDAQ declined by 0.1%, and the Russell 2000 rose by 0.2%. Trading in the US Treasury market was quiet, the yield on the 2-year note increased four basis points to 0.73%, and the 10-year yield increased by two basis points to 1.51%. Oil prices increased by $1.53 or ~2%, with WTI closing at $75.15 a barrel. EIA oil inventories showed a larger draw than expected at 3.58 million barrels. Gold prices increased by $16.2 to close at $1828.10 an Oz. Copper prices increased by 1.5% or $.0694 to $4.463 a Lb. Bitcoin tumbled 8% on the week and closed the year at $47,052.

Economic data was positively skewed for the week. In the labor market, Initial Claims and Continuing Claims trended lower to 198K and 1.716m, respectively. The S&P Case-Shiller index increased 18.4% in October, while Pending Home Sales decreased 2.2% in November. Finally, the Chicago PMI rose to 63.1, better than the consensus estimate of 61.5.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.