Weekly Market Commentary -3/25/2022

-Darren Leavitt, CFA

It was a hectic week for investors as US financial markets tried to post a second consecutive week of gains. Geopolitics continued to influence market action. President Biden traveled to Europe to meet with NATO allies, the European Union and finished the week visiting Poland. Strategists from Citibank and Bank of America had significant calls on the Federal Reserve’s policy rate path, which sent rates higher across the curve. Economic data showed a strong labor market, a tepid housing market, and weakening consumer sentiment.

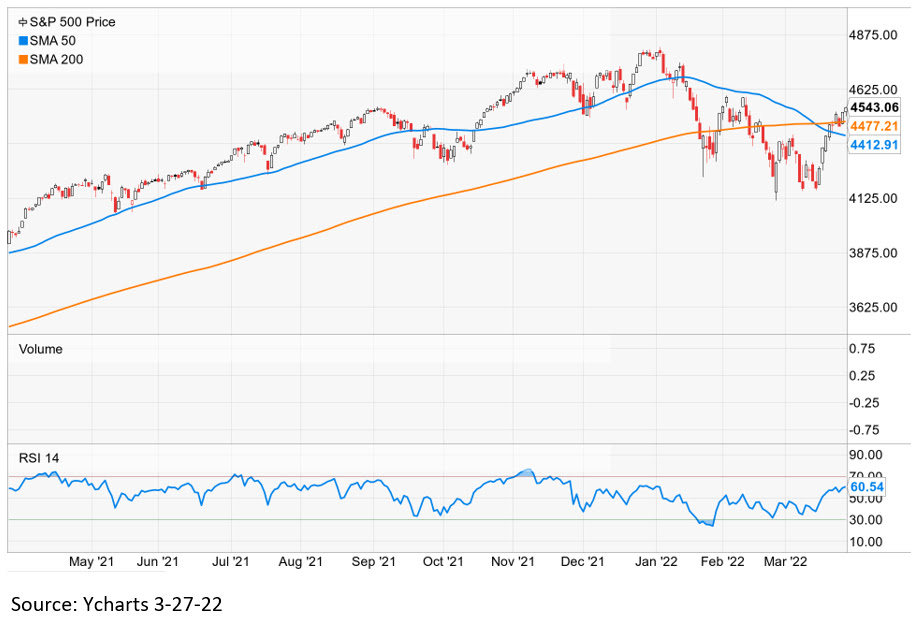

The S&P 500 gained 1.8% and regained its 200-day moving average of 4476. The Dow added 0.3%, the NASDAQ outperformed with an advance of 2%, and the Russell 2000 lost 0.4%. The US yield curve shifted higher and inverted at 3’s & 5’s versus the 10-year. The 2-year yield increased by thirty-three basis points to 2.29%, while the 10-year yield rose by thirty-four basis points to 2.49%. Oil prices increased by 10.5% or $10.80, with WTI closing at $113.83 a barrel. Multiple factors played into the oil trade this week. A ban of Russian oil from the EU was sidelined. There was an attack on a Saudi oil field that pressured supply concerns. There was rhetoric around another release of the Strategic Petroleum Reserve, and Chevron was given clearance to restart operations in Venezuela. Gold prices rose by $22 to $1952.90 an Oz. Copper prices fell by $0.4 to $4.69 an lb. Bitcoin gained nearly $3000 on the week, closing at $44,686. Of note, the $/yen closed at 122.11, and the Euro/$ fell to 109.86 on the divergence of central bank policy.

President Biden met with his counterparts in the EU and NATO to discuss the war in Ukraine. Officials warned Putin on the use of unconventional weapons and reiterated that any attack on a NATO member would be met with severe consequences. The President also warned China on helping Russia and outlined export controls on Chinese goods as a deterrent. The war has entered its fifth week with millions of refugees fleeing to Poland, where Biden finished his European trip. While in Poland, the President called Putin a war criminal and suggested that Putin be ousted from office. The administration later toned down the call for regime change which was then echoed by some European leaders.

Citibank and Bank of America strategists had significant calls on the Federal Reserve’s policy rate. The calls induced volatile trade in the US Treasury market that continued to see losses. Citi sees four consecutive fifty basis point rate hikes followed by two twenty-five basis point hikes. BofA sees fifty basis point hikes in the June and July meetings, followed by twenty-five basis point hikes at each subsequent meeting this year. The calls dampened sentiment on the Consumer Discretionary sector and the Homebuilders. 30-year mortgage rates increased to 4.375-4.75%.

Global preliminary PMIs were mixed. In the US, March PMI Manufacturing came in at 58.5 versus February’s 57.5. The Non-Manufacturing reading was also better than the prior month at 58.9. The labor market continued to show record strength. Initial Claims fell by 28k to 187k, the lowest reading since September 1969. Continuing Claims fell by 67k to 1.35 million, the lowest level since January 1970. The tight labor market further stoked wage inflation fears. Housing data came in less than expected. New home sales fell by 2% to an annually adjusted rate of 772k the street was looking for 820k. February Pending home sales fell 4.1%. The final reading of the University of Michigan’s Consumer sentiment fell to 59.4 versus the prior reading of 62.8. This is the lowest reading since October of 2012. Interestingly, 32% of the respondents thought their financial condition would worsen in the coming year, the highest level ever seen since the data set was created. The outlook on inflation relative to wages was cited as the decline.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.