Weekly Market Commentary – 3/10/2023

-Darren Leavitt, CFA

Wall Street endured a difficult week with volatile fluctuations in equity and fixed-income markets. Fed President J Powell’s testimony in front of congress kicked off the market’s chaotic week when he suggested a higher terminal policy rate and that the policy rate would probably remain elevated for some time. The Fed Chair’s remarks on the first day of testimony to The Senate Banking Committee and the House’s Financial Services Committee initially moved the probability that the Fed would raise rates by another 50 basis points in the March meeting to nearly 80%. By the end of the week, the probability had fallen to below 30%. The February Employment Situation report and, more likely, the collapse of Silicon Valley Bank strengthened the argument for a 25 rather than a 50 basis point rate hike.

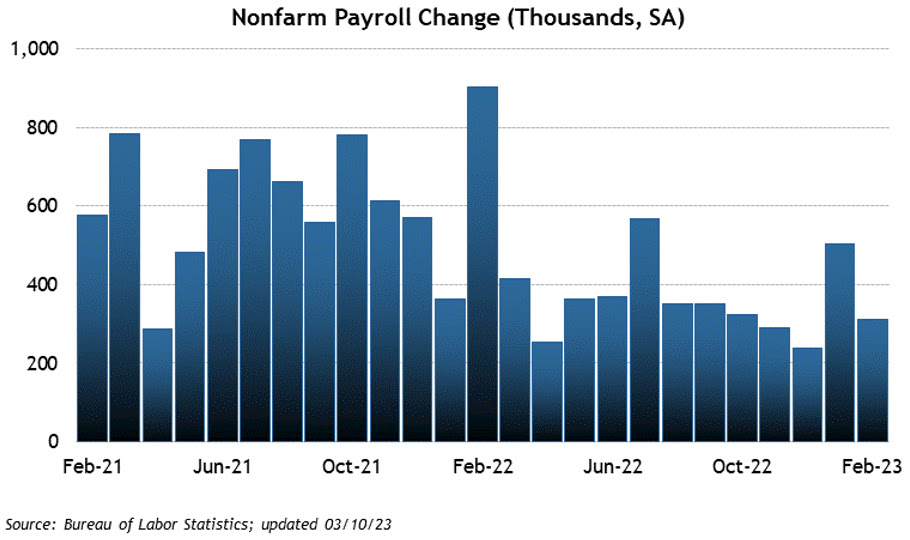

The Employment Situation report gave hawks and doves something to justify their positions. The headline number showed better-than-expected job creation with 311k new payrolls; the street was looking for 205k. Similarly, the Private Payrolls number of 261k beat expectations of 203k. The strong payrolls number would generally reinforce the need for more rate hikes; however, countering that argument, the Unemployment rate ticked higher to 3.6% from 3.4%, and the Average Hourly earnings figure came in below expectations of 0.3% at 0.2%. The higher unemployment rate came as Initial Jobless Claims for the week finally topped 200k, and Continuing Claims data showed a 69k increase to 1.718M.

The ripple effects from the collapse of Silicon Valley Bank are just starting to manifest themselves. Yes, on Friday, equity shareholders felt the full blow of not having the stock reopen. Still, multiple ramifications are yet to play out, and while contagion to much larger banks has initially been pushed aside, investors were reminded of how quickly things can deteriorate. The run on the bank was induced by the realization that it had made some questionable investments, its exposure to the highly speculative venture capital markets, and a call to withdraw deposits to start-up companies from a well-renowned venture capitalist, Peter Thiel. The latter seemed to be the death nail, as deposits left the bank faster than the bank could raise capital or find a white knight to stop the hemorrhaging. The collapse pulled back expectations that the Fed will raise the policy rate by 50 basis points and has complicated an already tricky financial landscape. The safe-haven ballast of US Treasuries, which has been absent for some time, returned to markets last week, and ironically, this return may trouble the financial sector further.

The S&P 500 fell 4.5%, the Dow lost 4.4%, the NASDAQ shed 4.7%, and the Russell 2000 tanked 8.1%. Of no surprise, financials showed the most weakness last week, especially regional banks. Of note, the S&P 500 broke the key technical levels of the 50-day and 200-day moving averages and will have some work to reclaim those levels to stave off a further technical decline. In contrast, a safe-haven bid was ever-present in the US Treasury market as yields fell across the curve. The 2-year note yield fell twenty-seven basis points to 4.59%, while the 10-year yield fell by twenty-six basis points to 3.7%. Oil prices fell 3.8% or $3.11 to close at $76.68 a barrel. Gold prices advanced by $12.90 to $186.10 an Oz, and Copper prices fell $0.05 to $4.01 an Lb.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.