October 23rd, 2020

-Darren Leavitt, CFA

Markets traded sideways for much of the week as investors continued to watch Washington fail to negotiate another tranche of stimulus. 3rd quarter earnings continued to roll-out with results coming in mixed. The familiar trade rotation out to Mega-cap tech and into value-oriented cyclicals was also on during the week. Economic data reported was a source of encouragement, especially on the employment front. News surrounding a Covid-19 vaccine and treatment was positive and helped market sentiment during the week.

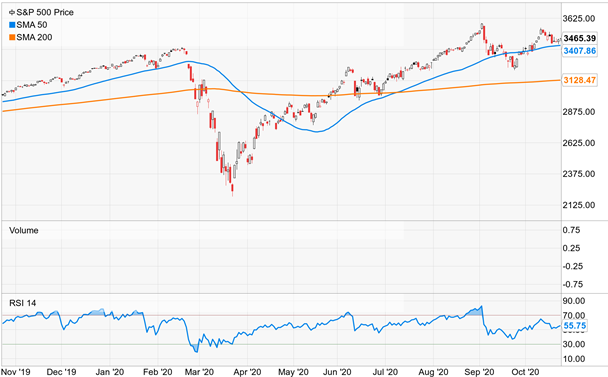

For the week, the S&P 500 lost 0.5%, the Dow fell 0.9%, NASDAQ lagged, giving back 1.1%, and the Russell 2000 bucked the trend with a gain of 0.4%. The US yield curve steepened with the 2-year note yield increasing by one basis point to close at 0.16%, and the 10-year bond yield jumping ten basis points to close at 0.84%. The steepening action benefited the financial sector, which gained over 1% on the week. The commodity complex’s price action was relatively muted, with Gold losing $1.30 to close at 1905.20 an Oz and Oil shedding $1.02 to close at $39.83 a barrel. There were no changes to our models during the week.

For most of the week, investors watched for progress in Washington on another tranche of stimulus. By the end of the Friday session Treasury Secretary, Mnuchin, announced that there were still significant differences in the negotiations. The Presidential debate yielded very little new information but addressed some of the political posturing in stimulus negotiations that seemed to cast even more doubt on a possible deal. It is probably unlikely a deal gets done, but surely the rhetoric will continue to keep investors’ attention.

A blowout quarter from SNAP highlighted 3rd quarter earnings results; the stock gained over 50% following its announcement, which helped propel the communication services sector 2.1% higher on the week. On the other side of the coin, Netflix, Intel, and American Express disappointed investors. Next week will be another big week for earnings announcements and will showcase Apple’s results.

Initial Jobless Claims for the week showed real improvement coming in at 787k, which was better than the prior reading of 842K and the consensus estimate of 875k. Continuing claims also showed continued improvement coming in at 8.37 million down from 9.39 million in the preceding reading. Existing home sales came in better than expected at 6.54 million versus the consensus estimate of 6.15 million.

There was plenty of news regarding the uptick in coronavirus infections, treatment, and the pursuit of a vaccine that helped investor sentiment. Gilead’s remdesivir received FDA approval for treatment of Covid-19, AstraZeneca and Moderna announced that they might seek FDA approval for their Covid-19 vaccines as soon as the end of December, and J&J announced that it would continue its trial on its vaccine after halting the trial early last week.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.